Amazon Prime takes on Netflix, Binge with ad-supported streaming service set for mid-2024; pledges 5 million Australian users at launch, streamers set for $100m advertising take from broadcasters

What you need to know:

- Amazon in market telling media buyers and brands Prime will launch a paid ad tier in Australia by mid-2024, touting reach of 5 million and three-month launch packages at $150,000-$250,000.

- The play means Amazon can take brand dollars through Prime Video ads as well as performance through its Amazon.com retail media business – and will likely aim to link the two.

- Buyers surprised by the high audience numbers Amazon quoting for Prime.

- The move adds pressure to Netflix, which is beginning to recover ground and build audience numbers after a poorly executed ads launch, as well as other streamers and TV networks.

- Omnicom Media Group forecasts subscription-based video services will take $75-100m in advertising next year, most of it coming from the structural audience shift out of free-to-air TV.

- But OMG investment chief Kristiaan Kroon thinks BVOD will also start to see revenue leakage from mid-2024.

SVOD is going to take some growth from BVOD. It takes time to scale, for advertisers to understand the platform, how optimise their engagement etcetera. But it will be a growing competitor to BVOD through 2024, particularly around the mid-year point.

Pay more or get ads

The once grand proposition of subscription-based streaming services eliminating annoying TV ads forever is all but over as Amazon Prime works the Australian market for a planned launch mid-next year off a base advertising tier for 5 million local members. Those who don’t want ads can pay an additional $3 per month in their Amazon Prime bundle, which sits at $79 annually or $9.99 monthly and includes free online shopping delivery and Prime Video access. Amazon Prime is understood to be capping ads at four minutes per hour, the same as Foxtel’s Binge service. Paramount+ last month also announced its intent to launch an ad tier next year and Disney+ is expected to do likewise, though details on the latter remain scarce.

After Netflix’ troubled foray into an entry-level subscriber ad-supported service in Australia last year, anecdotal reports suggest it has found its advertising mojo under a deal with Microsoft Advertising, which currently manages the streamer’s advertising sales globally and locally.

Omnicom Media Group (OMG) has forecast subscription-based video services will nab $75-100m in advertising next year, most of it coming from the structural audience shift out of free-to-air TV, which is gathering pace.

Nine CEO Mike Sneesby, the architect behind the locally owned Stan, which will be the outlier in the SVOD posse shunning ads, told Mi3 last week the viewer tipping point from terrestrial TV to digital streaming would be a “five year horizon”.

OMG said Foxtel Media will take the biggest share this year of the streamer advertising pool ahead of Netflix.

Two-speed streaming

The emerging SVOD advertising army in Australia will also test two distinct operating models: globally managed, platform-based advertising sales structures like Netflix and Amazon versus local people-led sales teams from Foxtel Media and Paramount+, which will be managed by Network Ten’s unit, both under common ownership from the US-based CBS.

Amazon Prime’s local ad service, led by Willie Pang, former Australian boss of GroupM’s agency Mediacom, now EssenceMediacom, will push all subscribers onto its ad tier by default. That could quickly deliver scale; ad buyers and media buying group investment chiefs say the firm is now engaging heavily ahead of an Australian launch slated for mid-2024 and it’s talking numbers that would make it ten times bigger than its nearest streaming rival. OMG, GroupM, IPG’s Mediabrands and Dentsu Media are all understood to be in negotiations with Amazon Prime on behalf of blue chip advertisers. Publicis’ position, which has Disney+ as a client, is uncertain.

SVOD ads plus retail media

Amazon Prime has something its rivals do not: a direct, attributable line from brand advertising to tactical ads designed to drive a transaction via Amazon.com, which means it will likely woo advertisers for budgets across its portfolio, gunning for TV’s share of brand dollars through to performance, search, ecom and retail media.

Last year Amazon posted Australian revenues of $2.6bn, of which $1.3bn came from its online store, $250m from Prime subscriptions, $316m from fulfilment and distribution – and $100m from ads via its ecom play.

While locally the ad business is a relatively small part of that pie, Amazon globally derives huge margin from its circa $40bn advertising juggernaut, without which it would be loss making.

Those dollars come from its on-network ad business – sponsored listings and ads on Amazon.com – and increasingly, off-network, where Amazon can use shopper data to enable targeting around the web. Now it’s aiming to tie the two together, and close the loop both and attribution and, where it can, fulfilment.

Next wave incoming

Either way, Omnicom Media Group investment chief Kristiaan Kroon thinks the local streaming ad market is about to significantly expand.

“Yes, Amazon’s in market [locally] talking to big advertisers and we’re engaging heavily with them,” he told Mi3. “They’re going to roll out [ads on Prime] to all of their subscribers, so they will potentially be the biggest in market.”

Prime subscribers that don’t want to see ads will have to pay a few more dollars a month – $2.99 in the US.

“Prime’s a value play in that it’s bundled in with free [online shopping] delivery. So I think a lot of people will accept ads if the consumer experience is reasonable,” added Kroon.

He said the impact on the likes of Netflix and Binge ad revenues remains to be seen but predicted that the TV networks will start to see their BVOD incomes take a hit.

“SVOD is going to take some growth from BVOD. It’s not going to disrupt it at this stage is my view, because it takes time to scale, for advertisers to understand the platform, how optimise their engagement etcetera, so that will take time,” said Kroon. “But it will be a growing competitor to BVOD through 2024, particularly around the mid-year point.”

One TV network exec who did not want to be named but was across the Amazon Prime advertising push suggested it could face a 20 per cent churn out of the Amazon Prime ad tier base of 5 million. The exec suggested it did not have the content line-up to attract the viewer frequency of rivals like Netflix and Binge.

Netflix recovering

While Netflix has underwhelmed – Kroon earlier this year questioned whether the world’s biggest streaming platform was fully committed to launching an ad business in Australia – it is said to have boosted its Australian subscribers significantly in recent months after a global crackdown on password sharing, forcing those who have hitherto paid zip for the service into its cheapest, ad-loaded entry point.

Kroon reiterated his view that Nine may soon rue not launching an ad tier on Stan.

“I think they will strategically regret that in the mid-to-long term, because that market is going to evolve and grow quickly,” said Kroon. “They have, I think mistakenly, decided not to be in that conversation.”

That sentiment tallies with data from other media agencies: Zenith’s Imagine Panel data, which has tracked SVOD consumption over the last 12 months, suggests circa 7 per cent of Netflix’s Australian subscribers are now on its cheaper ad tier, broadly in line with global figures after the company reported 70 per cent growth in users opting for ads in the third quarter. Seven per cent of 6.1 million Australian Netflix subscribers opting for ads, if correct, would equate to north of 400,000 ad tier subscribers, representing huge growth from under 100,000 customers at the start of the year.

“Netflix went first last year and they made some clear mistakes around audience forecasting. I think they’ve largely resolved those through the password [sharing] crackdown, which has driven significantly more numbers into its ad tier. So I think they’re regaining the lost confidence that the market felt,” said Kroon.

He contrasted that approach to Foxtel’s Binge – which like Amazon rolled all of its basic subscribers onto the ad-tier unless they specifically chose to pay more for no ads. That bought instant scale, with Foxtel boss Mark Frain claiming audiences of 400,000 from the get-go, with those numbers subsequently holding up.

“Binge had a solid launch, with no problems for advertisers and I think Binge will do well next year,” said Kroon.

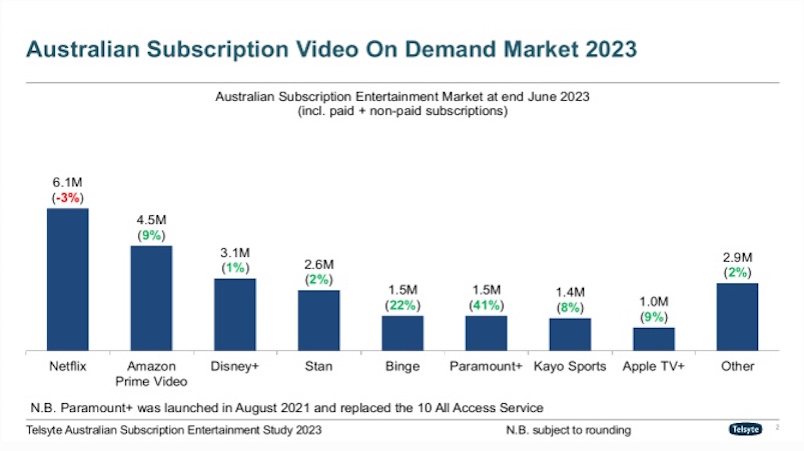

Telsyte SVOD audience data, June 2023.

Prime numbers

According to Telsyte data, Amazon Prime had 4.5 million subscribers in Australia as of June 2023. How many of those subscribers will remain open to brands post-launch remains to be seen, but the firm has told advertisers in the US to it expects Prime ads to reach some 115m monthly users. With its US subscriber base estimated to be around 159m, that suggests a circa 72 per cent conversion rate.

If that rate applies in Australia, it would give Prime ads a monthly audience of close to 3.25 million households.

However, Amazon is pitching to Australian advertisers the capability to reach 5 million Prime customers with ads, which suggests its subscriber base is either substantially higher than Telsyte’s estimates – and media buyers gave Telsyte a wrap for being closest on the audience numbers – or the firm locally is factoring-in zero churn to its higher priced ad-free tier.

“The general view is that Amazon Prime’s user numbers are much larger than most anticipated,” said one media agency exec.

Telsyte’s principle analyst, Foad Fadaghi, said its figures, derived from a combination of consumer research and in-market interviews, had been heavily criticised for overestimating Amazon prime’s base but had now “been vindicated”.

Fadaghi said cost of living pressures would prove telling next year – Telsyte’s research showed consumers had already cut spending on alcohol and beverages, cafes, dining out, travel and clothing and accessories but SVOD services had been mostly spared. Last week’s interest rate rise, he said, may change the number of streaming services they receive.

“If a household has already forgone holidays, alcohol, travel and so-on this year, only SVOD may be left for a lot of people given how difficult it is,” Fadaghi said.

Where Amazon Prime’s number lands remains to be seen. Either way, the firm is effectively rolling out an ad tier and a price rise at the time. The end-to-end, full funnel proposition – at scale – gives both streaming pure-plays and TV’s established order a new problem to ponder.