Martech spend at 10-year low, broader budgets crunched but pressured marketers shielding paid media – CMOs, agency bosses on where axe is falling, defence mechanisms

What you need to know:

- The latest Gartner CMO Spend Survey shows marketing budgets as a proportion of overall company revenue are the lowest they’ve been in the last five years, falling to 7.7 per cent.

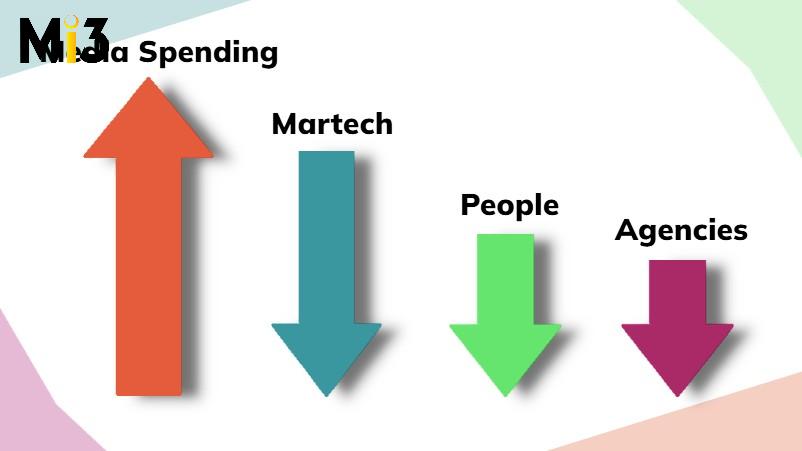

- The mix of spend however is flipping. According to the analyst firm, spend on martech is on the decline, falling to the lowest it’s been in 10 years.

- By contrast, paid media spend is up and is now the biggest slice of the budget pie at 27.9 per cent.

- In an ‘era of less’, Gartner sees a normalisation of marketing spend as well as a huge emphasis on CEOs expecting efficient growth from their marketing functions.

- According to one financial services CMO Mi3 spoke to, ringfencing media is a must given the company’s growth agenda. Yet the budget is flat for the first time in five years, every dollar is being scrutinised, and martech, agency and staff spend are all potentially up for constantly recalibration. An FMCG CMO painted a similar picture, saying budget is holding but driving brand and initiatives that also drive sales and margin are critical in FY25.

- Uber’s APAC marketing chief, Andy Morley, says overall marketing investment remains at similar levels. But he flagged a more conscious approach to portfolio choices to ensure every dollar is maximising impact on growth, particularly future growth bets.

- Morley is also worried about reductions in both labour and agency spend simultaneously whilst media spend is increasing, believing it indicates companies are putting a lot more pressure on their teams and partners to do more with less resources.

- Chief Media Officer for Publicis Groupe ANZ, and CEO Spark Foundry ANZ, Imogen Hewitt, is another who claimed there’s no “universal trim to budgets” going on. Instead, she spied nuances in how clients view investments right now based on specific organisational factors and industry conditions.

- For Orchard chief strategy officer, Mikaela Crimmins, there’s concerted effort to ensure marketing budgets are being spread across all areas of the marketing funnel, not just for top-of-funnel activities as a way of maximising customer growth and spend.

This is about protection. If you want to drive growth, you need to make sure you're protecting your share of voice, and the most important way you can do that is by protecting your media budget.

Marketing budgets are snaking down as a percentage of company revenue, and spending on martech is on the wane in a year of both opportunity and challenge for CMOs, according to the latest Gartner CMO Spend Survey.

Based on a survey of 395 CMOs and marketing leaders, the report reveals average marketing budgets fell to 7.7 per cent of overall company revenues, down from 9.1 per cent in 2023 and well off the 10.5 per cent recorded five years ago. Only one in four marketers felt they had sufficient budget to execute their strategy, and most reported having to do more with less in 2024.

What’s interesting is where the dollars are being allocated. Paid media investments grew to 27.9 per cent of budget in 2024. By contrast, spending fell significantly across martech (23.8 per cent), followed by talent and agencies. It’s a downward technology investment trend Gartner said has left martech spend sitting at its lowest level for a decade.

“In the four years preceding the pandemic, average marketing budgets were 11 per cent of overall revenue. In the four years since, they’ve dropped to an anaemic 8.2 per cent,” Gartner VP, Marketing Practice analyst and co-author of the report, Ewan McIntyre said. It’s indicative of CEOs in 2024 expecting efficient growth.

“There’s an expectation there’s been a lot of investment over a significant period of time. Reading between the lines of this data, it’s now time for this to pay back,” McIntyre said. “This is the time we [companies] get some money back from all of this.”

McIntyre also described 2024 as the “era of less” in marketing. “That’s not necessarily a bad thing. Perhaps this is the normalisation of marketing investment,” he said.

In the first half of the last decade, Gartner famously predicted CMOs would spend more on IT than CIOs. That apparently happened briefly in 2016. But it wasn’t sustained, even though technology as a share of the martech budget kept growing. 2018 represented the high water mark for martech expectations, peaking at over 29 per cent. In contrast, paid media reached a low ebb that same year of 23.2 per cent.

“The kind of hyper-investment into some of these areas was always going to normalise. Perhaps this is the year where we are seeing this transition into a reality where digital and technology are just normal parts of the CMOs toolkit,” McIntyre told Mi3.

Those relativities have now flipped.

Paid media is now clearly the biggest slice of the budget pie, with investments in media increasing from 25.6 per cent last year to 27.9 per cent in 2024.

There is a caveat though: Total spending on martech could be higher as IT has reasserted more control over spending, McIntyre said. It’s just that money is coming from a different cell in the corporate spreadsheet.

Against this and in the intervening eight years, spending on labour and agencies has bounced about in a narrow band of between 22 per cent and 24.5 per cent of the total marketing budget.

Media spend is decidedly being ringfenced, even if it’s dipped slightly in terms of ratio to company revenue to about 2 per cent of enterprise revenue.

“This is about protection,” McIntyre said. “If you want to drive growth, you need to make sure you’re protecting your share of voice, and the most important way you can do that is by protecting your media budget.”

Within this media pot, digital continues to dominate as a growing share of paid media spend, taking 57.1 per cent of budgets in 2024, up from 54.9 per cent in 2023. Top channels include search (13.6 per cent), social advertising (12.2 per cent) and digital display advertising (10.7 per cent). Among offline channels, event marketing (17.1 per cent), sponsorship (16.4 per cent) and TV (16 per cent) topped the investment chart.

Noting CEOs are more likely to say growth is the priority this year than at any time in the last 10 years, the move by CMOs to ringfence media budgets speaks to how media is seen as a super-efficient way of driving growth, McIntyre said.

“That’s the positive side of it. The challenging side of it is that it is a bit of a gamble because it relies on you being able to make the right media investments and to be able to optimise that spend,” he said.

“And if we’re going to protect this spend, it appears marketers are sacrificing resources across tech, people and agencies to make ends meet.”

The kinds of challenges and choices McIntrye says marketers will need to make are familiar to Adore Beauty CMO Dan Ferguson, who told Mi3 the business will continue to invest in areas that maximise the efficiency and effectiveness of its marketing spend. “This includes building and leveraging FY24 investments in Retail Media and MMM (marketing mix modelling) to amplify brand reach and support new customer acquisition costs.”

Asked about the kinds of areas he would ring-fence during budget meetings Ferguson said: “Our loyal returning customers contribute around 80 per cent of all revenue, so finding relevant and engaging ways to cost-effectively reach them will remain an important part of our FY25 plans.”

And reflecting the priority identified by Gartner to protecting media investments, he added, “At the same time, we’re focused on profitable new customer acquisition so we’ll continue to diversify our channel mix to increase brand awareness.”

There is always analysis and discussion around productivity and efficiency of the rest of the spend as well. That’s spend on partners, agencies, martech stack, analytics – all of it beyond working media. It’s the working media that people ringfence – we say 'we’re not touching that as that’s our growth driver'.

Fin services CMO: Everything questioned

There’s absolutely no doubt everyone is leaning in to find cost management levers, judging from the CMOs and agencies Mi3 spoke to.

The marketing chief of one ASX-listed financial services firm said their budget wasn’t “trimmed” per se. But they did admit FY25 will be the first year in five years marketing spend will be flat. Thanks to early work building out marketing mix modelling to prove out the business case for marketing spend, the CMO had been increasing year-on-year marketing spend by double digits up until this point.

“There is a lot of rigour coming into the numbers – I’m getting questioned about everything,” the CMO told Mi3. “Every organisation is really having to lean in and pull the cost management lever. My observation in my organisation is it’s not just marketing, it’s across the board. In fact, marketing tends to be the last place people look here as they understand the value of that as a growth level. We have a growth strategy.”

Just as the Gartner’s global survey indicates, it’s the rest of the marketing budget spend outside of media – agencies, partners, martech, analytics, tools and headcount – that’s most up for scrutiny for this financial services CMO. But rather than taking things out completely, it’s a game of efficiency everywhere you look.

“There is always analysis and discussion around productivity and efficiency of the rest of the spend as well. That’s spend on partners, agencies, martech stack, analytics – all of it beyond working media. It’s the working media that people ringfence, and we say we’re not touching that as that’s our growth driver,” the CMO continued.

By contrast, where there is an opportunity to use new technology and tools to remove duplication or manual processes, marketers are keen to hear it. And that mentality is extending to people cost / FTE headcount.

“I look across the board and ask: Where can I innovate in the operating model to take cost out, or remove duplication. Have I got the right agency model in place given some of the changes happening in our organisation? Have I got the right capacity in the team and therefore, do I have the right structure?” the CMO said. “So yes, I do look at my people cost but also if I have the right partners delivering the right things.”

Such efficiency thinking led to the decision to in-house the majority of customer marketing capability previously sitting with tech vendors and partners over the last two years, saving hundreds of thousands of dollars per year. Similarly with FTE targets, restructuring and reorganisation are ever-looming depending on requirements, capacity and the fluctuating remit of the chief marketing officer.

“It’s constantly saying just because we set it up that way five years ago, is it the right way to do things today or can we do it in a more efficient way,” the CMO added.

It’s a similar story for a CMO in FMCG, who told Mi3 there’s pressure to do more with less. “While our budgets for FY25 haven’t been locked in just yet I expect it’ll remain at the same level,” the CMO said. “That said, retainers / sponsorships / memberships and subscriptions will all be evaluated on their merit. The priority is to drive brand and initiatives that drive sales and margin.”

I think the worrying trend is seeing reductions in both labour and agency spend simultaneously whilst media spend is increasing, which indicates companies are putting a lot more pressure on their teams and partners to do more with less resources. Whilst I've no doubt there are some efficiencies to be made, I hope we're not burning out marketers and agencies in the industry.

Uber: Remapping routes

At Uber, overall marketing investment remains at similar levels. But APAC CMO Andy Morley flagged a more conscious approach to portfolio choices to ensure every dollar is maximising impact on growth, particularly future growth bets.

“Our biggest focus has been looking harder at our media strategies and whether there are ways to achieve the same levels of impact through smaller investments by bringing owned, earned and paid together more cohesively,” Morley told Mi3. “I think it’s important we keep revisiting our principles and looking for smarter ways to activate in the market. And we’ve had some big wins with this.”

Equally, a lack of budget flex led Uber to park ambitions to “activate big” with the 2024 Paris Olympics despite the success it’s had through sports and events marketing like the Australian Open.

“We won’t compromise on doing big bold creative, including investing in top talent, and also will continue to innovate and take risks with non-traditional campaign work,” Morley continued. “The outsized impact we’re seeing overall from earned reach and campaign effectiveness when we get these things right is huge, and diluting our investment and focus here would create risk to our brand salience and media ROI overall.”

Morley wasn’t surprised organisations are trying to pull spend out of tech capital to fund increases in media to help fuel immediate growth.

“The priority right now is building growth momentum. I think the worrying trend is seeing reductions in both labour and agency spend simultaneously whilst media spend is increasing, which indicates companies are putting a lot more pressure on their teams and partners to do more with less resources,” he said. “Whilst I’ve no doubt there are some efficiencies to be made, I hope we’re not burning out marketers and agencies in the industry.”

We’re seeing more lateral commercial discussions – pay for performance models, shared revenue models, output-based models. Pressure on all sides can have the benefit of forcing innovation in the way we work and the way we value that work.

Publicis: squeezing budget balloons

Chief Media Officer for Publicis Groupe ANZ, and CEO Spark Foundry ANZ, Imogen Hewitt, is another who claimed there’s no “universal trim to budgets” going on. Instead, she spied nuances in how clients view investments right now based on specific organisational factors and industry conditions.

In other words, horses for courses.

“There are multiple factors influencing budgets: The performance of individual client businesses and/or the vertical in which they operate; how advanced each client’s understanding is of their drivers of growth and key metrics; how impacted each client business is by cost-of-living pressures, the cost of ingredients or parts, rebounding or otherwise supply chains,” Hewitt said. “We have seen increases in budgets and decreases in budgets this year as a consequence of the very specific nature of how those choices are made from one client to the next, one business reality to the next.”

Hewitt also believed where investments have been trimmed, they’ve been proportionate. “If there is less or paused investment in martech, for instance, then we’ve seen reductions in resources relative to that,” she said.

“What we have also seen is re-prioritisation within investment areas. For some, now is a time to prioritise innovation and that may come at the expense of consistent paid media spend. For others, the priority is maintaining saliency and trust through economic volatility, which might mean a re-balancing of spend into brand over acquisition channels. Yet the exact opposite is proving true for others, where challenges on a business’ bottom line is producing pressure for short-term results over long-term investments.”

Hewitt applauded clients saying ‘no’ to the things they should (and do) usually say no to – like those pesky shiny new toys for the sake of it, or things “that cannot be quantified or modelled with any sense of surety”.

Taking an optimistic view to any budget cuts, Hewitt suggested tightening budgets breed ingenuity.

“We’re seeing more lateral commercial discussions – pay for performance models, shared revenue models, output-based models,” she said. “Pressure on all sides can have the benefit of forcing innovation in the way we work and the way we value that work.”

Less people, less marketing dollars, less access to big investments and unfortunately greater competition. But this is what makes us work a little harder and come up with fresh ways to generate long-term sustainable brand growth. We simply can’t rest on our laurels because we’ve never been able to.

Orchard: Spread growth bets

According to Orchard chief strategy officer, Mikaela Crimmins, there’s concerted effort to ensure marketing budgets are being spread across all areas of the marketing funnel, not just for top-of-funnel activities as a way of maximising customer growth and spend.

“While some agencies may be experiencing less investment in traditional brand activities, as the [Gartner] report suggests, it’s just a re-prioritisation of the channels and activities that demonstrate growth,” she said. “To be honest, this shouldn’t be a surprise to our industry. Our clients need to drive customer growth, and their budgets should support the parts of the supply chain that best achieve this.”

Unlike the financial services CMO interviewed for this story, or the recent In-House Agency Council (IHAC) report, which suggests a swing to bringing capabilities in-house to drive growth, Crimmins claimed several in-house shops have come back to agencies in search of specialist skills.

“Fresh thinking coupled with specialist skill sets is what will give any brand a competitive edge,” she said.

Sweating stacks

As to the reductions in martech spend and what they signify, Crimmins response was: “You don’t buy a smart fridge to only use the ice maker”.

“Yet for a while, many brands were leaning into enterprise martech and doing exactly that, paying exorbitant licensing costs to only scratch the surface of what the technology could do,” she said. “So, ‘sweat the asset’. Rather than adding another piece of technology to the martech ecosystem, get the most out of what you’ve already got.”

Along with making martech work harder, clients are looking to demonstrate business uplift before they invest in the next piece of the stack, said Crimmins. It’s the diligent thing to do.

“There are two things all clients won’t compromise on: the ability to demonstrate uplift and impact through measurement and data, and the ability to avoid data breaches or compromises to security through data security and governance,” she added. “One is positive, and the other is negative, and harm minimisation is always going to ring-fence budgets.”

Securing less of the budget ratio is also a reflection of talent for Crimmins. “We’re all starting to adopt what I like to call a +1 or as Gen Z may term it a ‘slashie’, a passion or skillset adjacent to your core expertise. This is Australia, we’ve got notoriously smaller budgets, with more competition,” she said. “We must work harder for a smaller share of the pie, and this requires us all to show a bit more grit or apply some fresh thinking.”

Yet even while Gartner’s latest report brings some concerns, Crimmins believed Australian marketers have always had to achieve growth with less.

“Less people, less marketing dollars, less access to big investments and unfortunately greater competition. But this is what makes us work a little harder and come up with fresh ways to generate long-term sustainable brand growth. We simply can’t rest on our laurels because we’ve never been able to,” she said.

“This is where things like creativity give brands in a market like ours that competitive edge. And creativity comes in many forms, how we find new customers, how we stand out in a crowded market, how we get tourists to flock to a state at the coldest time of the year, with a long-term brand platform like ‘Come Down For Air’ [Tourism Tasmania]. Yes, this is the era of less, but this is what Australian marketers have been training for … since forever.”