Pearman Media's Steve Allen turns sober on agency ad spend: 2023 full year 'worst in a decade', '24 to lift 3.65%

Pearman Media’s Director of Strategy & Research, Steve Allen, has provided a sobering outlook for the media market, hacking advertising spend growth from media agencies for the full 2023 calander year to under 1%.

SMI year-to-date (YTD) November figures show 2.3% growth in Media Market turnover, marking “the worst result in over a decade”, Allen said. Nine months of 2023 have underperformed compared to 2022, with only one month showing modest growth. He predicted total media spend in 2023 will finish up around 0.89% over 2022.

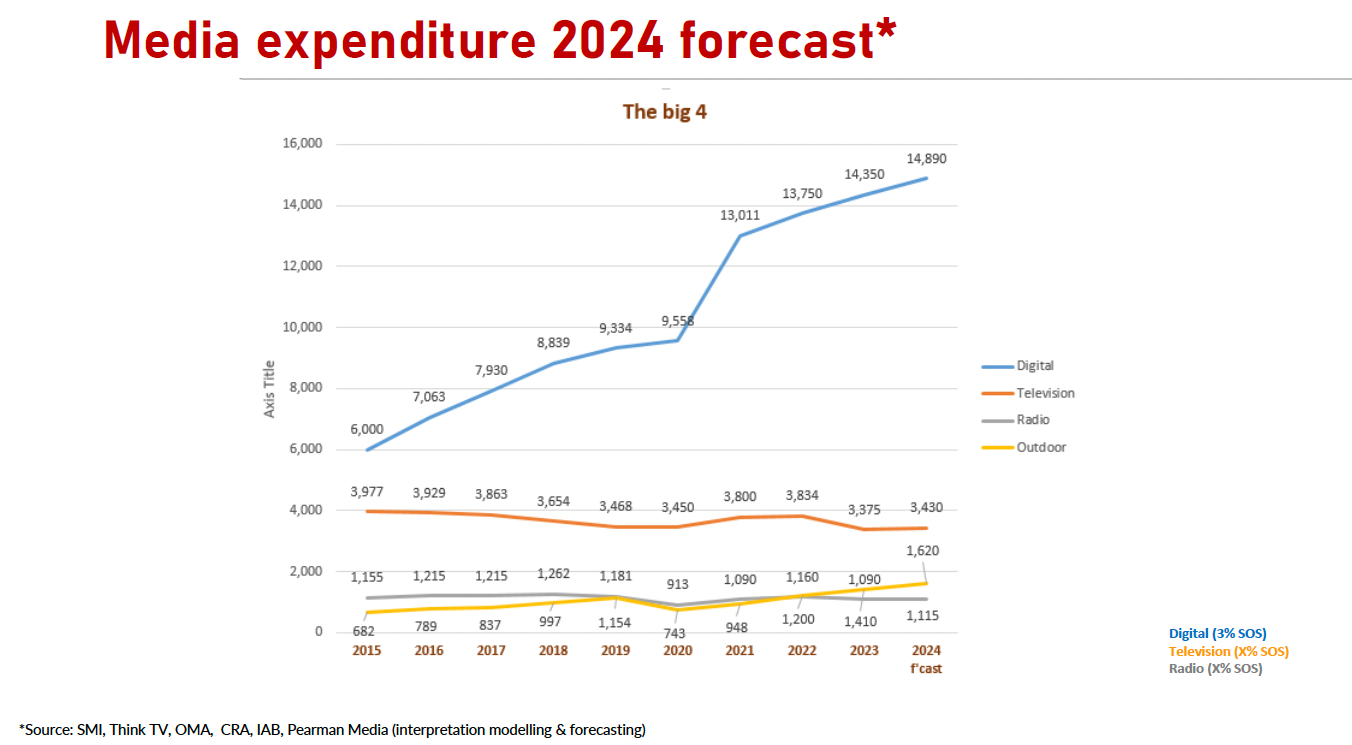

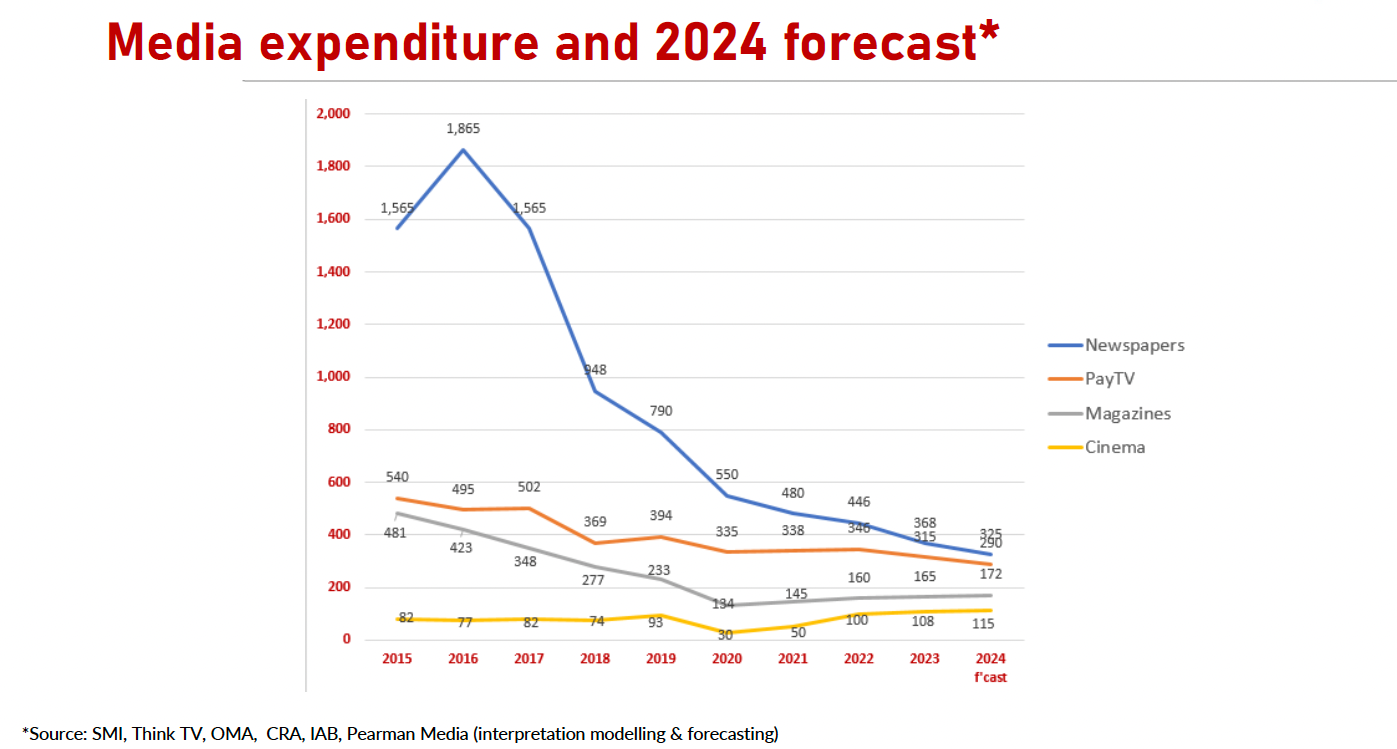

The highest recovery growth in 2023 have been in Outdoor, Cinema, and Magazines, while Digital remains the only consistent grower, despite facing pressure throughout the year. Allen’s media ad spend forecast for 2024 points to a slight improvement in 2024 of 3.65% growth for the total market.

“We see 2024 faring a little better with the consumer economic squeeze and the cumulative effect of 13 interest rate rises expected to impact strongly in Q2 of 2024,” Allen said.

Television slipped in the last year, but still largely held its recovery gains with revenue well above pre-pandemic revenue, due in large part to BVOD audience growth, Allen said.

“BVOD delivered explosive revenue, circa 25%, for television, nearly $500m for 2022, making up over 10% of total TV revenue. While advertisers are embracing BVOD due to its targeting ability, incremental reach boost and guaranteed delivery, BVOD growth was just 6% in the six months to June 2023), with no further data to date,” said Allen.

“We did not see either FTA TV nor PayTV ad revenue growing in 2023. BVOD and SVOD are having a distinct effect on viewing dynamics with VOZ data showing much of this lost viewing is recaptured in catch-up/time shifted viewing. AVOD (Advertiser-supported Video On Demand), has now entered the marketplace via Netflix and Disney+.”

Outdoor, Radio, Magazines and Cinema continued to recover modestly in 2023, Allen said and digital’s “historic stellar growth” flattened slightly more than 2022, though it now comprises over 65% of the total Media Market 2024 Media markets revenue forecast.