Westpac’s ‘In the Moment’ was a $70m+ real time decisioning flop; the bank tried again in 2023 with a tender for an off-the-shelf solution, then ditched it – as Big Four rivals go all-in

What you need to know:

- A decision by Westpac’s Executive Management Team (EMT) circa 2019 set-in train a series of actions that today sees the bank trailing its Big Four rivals in a key area of marketing and CX capability – real time decisioning.

- The EMT ignored the advice of Westpac staff as expressed in an internal discussion paper that recommended the bank buy either Pega or Salesforce to implement a real time decisioning engine. That paper was written after a significant market scoping exercise including pitches by vendors.

- The EMT instead backed a recommendation that the bank should accept an offer from EY which said that it could custom build the decisioning capability Westpac wanted from scratch.

- The problem was that the person who made that recommendation subsequently left – and without its internal champion, the project withered, died, and was written off.

- It was codenamed In the Moment and it was run out of Westpac’s analytics group.

- EY at the time was providing consulting services to help build Westpac’s Data Lake and leveraged that relationship to pitch its wares, say insiders.

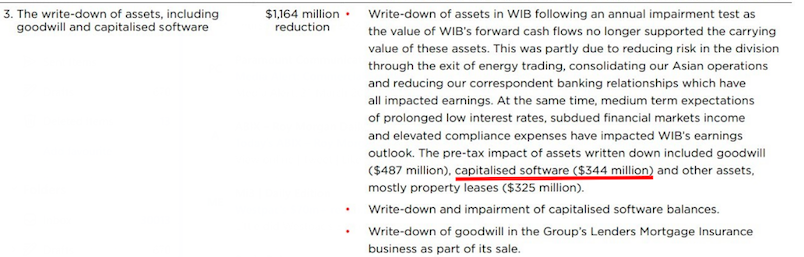

- The project failed and was jettisoned in 2021 as part of a larger set of impairments that hit the balance sheet that year. Apart from some of the work on data architecture, few of the deliverables built by EY for In the Moment are being used by the bank. In fact Westpac went back to the market looking for an off-the-shelf real time decisioning platform less than 18 months later.

- It issued tender in early 2023 for campaign management, journey orchestration and decisioning, with one of either Adobe, Pega or Salesforce said to be the preferred choice. But the project was de-scoped and decisioning removed.

- The bank instead chose to focus on implementing Adobe’s Journey Optimizer. Deloitte, not EY, is believed to be helping the bank with this new project.

- Commbank Bank (which invested in 2015), ANZ (2021), and (NAB 2023) are all honing customer decisioning capabilities.

- The circa $70m spent on In the Moment is relatively small in the context of Westpac’s overall development spending but the bank now risks competitive disadvantage in its marketing and CX activity due to a lack of real-time decisioning capability.

- In the Moment was meant to close the gap opened up by rival Commbank, and then subsequently by NAB, ANZ, and Suncorp. All four have invested in the Pega solution, which was recognised by Forrester Research as recently as January 2024 as best-in-class.

- Westpac personnel who were involved in the project attribute the problems underpinning the failure of In the Moment to (a) a platform that was not fit for purpose; (b) the unwillingness of senior execs including at EMT level to act on criticism of EY early enough and; (c) the unwillingness of project staff to challenge the project due to the perceived alignment of senior Westpac and EY executives.

- Per the deal signed with Westpac, EY now markets a product based on IP created during In The Moment under the name EY Cloud Data IQ Platform.

Real-time interaction management is a critical capability across vertical sectors, but especially in financial services, where it’s necessary to make brand-compliant and regulatory-compliant decisions about how to best serve customers across both digital and human-assisted channels.

In early 2023 it looked like Westpac was finally going to join its Big Four peers and buy Pega’s real time decisioning software. A tender was issued for an 18 month fixed term quote for an implementation partner for journey orchestration and decisioning from either Adobe, Salesforce or Pega, but ultimately the bank decided not to pursue real time decisioning, and instead it invested in Adobe’s Journey Optimiser to modernise campaign management.

It may revisit that decisioning choice later, but as matters stand today, its key rivals have now opened up a significant decisioning gap.

Too soon?

Perhaps the scars were still too fresh at Westpac.

Barely 18 months earlier the bank wrote off circa $70 million dollars’ worth of software development it spent with EY pursuing a do-it-yourself platform-build that was code named ‘In the Moment’. It did this against the advice its own staff after a senior decision-maker intervened to support a pitch by EY.

The executive leadership team backed that intervention, setting in train events that ultimately failed to deliver what Westpac wanted, and which left it lagging its competitors in a critical area of banking capability.

Commbank for instance has been building customer real time decisioning capabilities and delivering new customer functionality for almost a decade. ANZ started in 2021 and NAB kicked off its project early last year.

Real time decisioning is said to arm banks with advanced capabilities to drive strong lifetime customer value, while also compelling culture change and helping facilitate the move into new service areas. Westpac’s goal was to modernise its approach to customer experience and marketing to mirror the kinds of expectations created by a generation of consumers trained on apps like Uber and Netflix, according to project insiders. But that’s hard to achieve in an environment where it was still relying on legacy batch systems.

Traditional interactions with customers involve slow rates of adaption, and campaign changes can take weeks to execute. The goal was to turn weeks and months into minutes and moments, and to move beyond a 90s style segmentation and lookalikes approach, towards real time one-to-one customer interactions based on the data the bank possesses.

Building and investing in leading technology solutions is an important part of our strategy. Westpac has a number of insight and decisioning engines across the bank, including personal financial management, personal messaging, and artificial intelligence for micro-segmentation and optimisation of marketing programs.

In the Moment

EY was already helping Westpac to develop its data lake when it pitched Westpac on the idea that it could build a better decisioning mousetrap than RTIM incumbents like Pega and SAS, or even Salesforce.

But In the Moment proved to be an expensive misadventure that failed to deliver and had to be written off less than three years after it started. By that time the executive who championed it had already left Westpac for another bank.

Westpac said it does have some decisioning capability.

“Building and investing in leading technology solutions is an important part of our strategy. Westpac has a number of insight and decisioning engines across the bank, including personal financial management, personal messaging, and artificial intelligence for micro-segmentation and optimisation of marketing programs,” a spokesperson told Mi3.

“We are committed to a test and learn approach, which is critical to innovation and developing world-class technology. Software and engineering projects such as these bring benefits to the business across a range of areas, including data pipelines assisting our financial crime and fraud teams, insight integration across customer channels and real-time messaging preparation.”

Beyond that, and for confidentiality reasons, the spokesperson declined to comment on individual partners.

At its peak, Westpac insiders say there were almost 400 people working on the project almost all of them working for EY in various offices around the world. Costs quickly escalated. Mi3 has been told that apart from some work on data architecture which is still utilised today, everything else from that first tranche of work was “burned.”

The $70 million impairment charge the bank took to cover the work will sting, but it’s a rounding error compared to Westpac’s total IT spend. For instance the bank is said to have spent over a billion dollars on its mortgage origination development.

Westpac’s Big Four rivals all ultimately opted for a solution with Pega at the core.

Commbank in particular is considered a world leader in real-time decisioning. Along with Dutch Rabo Bank, it rates as one of the top real-time decisioning implementations in the world. Commbank’s Chief Data and Analytics Officer, Andrew McMullan has been effusive of the technology, telling Mi3 it underpins much of its customer interactions. It believed to have as many as 15 instances of Pega beyond just its Customer Engagement Engine, in areas such as credit risk decisioning and intelligence applications. It is also using the technology within external advertising, plugging in its first party data via the decisioning engine to the Google ad stack so that it can stop targeting customers that are not suitable for certain offers, and better communicate to those that are while also future-proofing against the deprecation of cookies.

ANZ Plus, ANZ’s new digital banking service which launched in 2022 is being used to provide its customers with the tools, insights and support to improve their overall financial wellbeing, after a project that saw the bank re-architecture its customer experience by providing ‘digital coaching’ through scaling its Next-Best-Action library and by adopting additional AI.

Of the Big Four, NAB is the most recent convert. Last year Mi3 reported that NAB had joined the crowded local market of bankers betting on AI-fuelled real-time decisioning to drive improvements in customer lifetime value (CLV). That move was taken in recognition of the fact that while traditional marketing clouds can deliver solid performance improvements, there are limits to its capabilities. The real-time decisioning call was also, in part, what drove NAB’s investment in a Tealium CDP.

The then NAB CMO Suzana Ristevski last year outlined the broad approach the bank aims to take on customer tech: “We wanted to create ‘one way, same way’ in our ability to do marketing communications,” she told Mi3.”That sounds simple, but for a bank, it’s actually quite complex, because we are piped into a number of different platforms. So it’s been an incredibly complex process,” she says. NAB is moving through the gears, though there are still a couple of pieces of the stack to swap out. We haven’t quite got off a couple of systems that we want to get off.”

Not happy

Mi3 spoke to project insiders at the bank as well as to technology providers working with the bank. They shared their information anonymously as they were not authorised to comment on behalf of the bank or their own businesses.

They paint a picture of a textbook technology project failure. A build-it-your-self pitch from an external vendor that lacked support from many of the key internal stakeholders; senior executives seen as too trusting due to long standing relationships and who they claim were too slow to address failures. But also, they suggest some internal critics were cowed by the seniority of key project sponsors and unwilling to speak truth to power. As the bills racked up, key stakeholders started bailing out, although this was more a case of high market demand for talent than the ship being abandoned, Mi3 was told.

Sources referenced project budgets, RFIs, Westpac discussion papers, and other internal documentation to validate their claims, and the information they provided was consistent across numerous conversations.

In formal terms In the Moment was a project run by Westpac’s analytics group with stakeholders from a range of disciplines including analytics, marketing and IT.

But the real impetus for the project was external — it was a consulting-driven pitch pushed hard by EY, and supported internally by key leadership figures.

The EMT ignored the advice outlined in the paper written by Westpac staff who provided their recommendations after a Request for Information process had played out and which included briefings from a range of vendors.

That paper recommended the bank choose either Pega or Salesforce. EY was not even on the list of staff recommendations. Internally, the staff wanted Pega, which was considered the best-in-class decisioning engine according to Forrester Research and still is, leading the latest Q1 2024 Forrester Wave Report for Real Time Interaction Management. Forrester also rates Salesforce as a Strong Performer in the same report. SAS, which is the only other company in the Forrester Wave leadership group in the report, was also consulted early in the process.

Ultimately DIY-decisioning won out – before $70m later, the plug was belatedly pulled.

Some project insiders were scathing of the decision by the bank to attempt to build its own decisioning engine. But they were even more critical of what some perceived to be the EMT’s reluctance to challenge EY, even when it was clear the project was going off the rails, saying there was only so much they could do to manage a vendor when the decision-rights were held so much higher up the food chain.

Ultimately though project insiders said In the Moment failed because it was not fit for purpose. Had the banks leaders followed the advice of their own staff, the EMT would have selected a decisioning engine they could plug in to existing channels.

Source: Westpac full year financial results 2021.

Martech v decisioning

Research analysts are clear about the capability gaps between traditional marketing technology (such as the Adobe Optimizer solution Westpac is currently implementing) and real time decisioning systems from the likes of SAS and Pega.

According to Forrester Research’s VP and Principal Analyst, Rusty Warner who spoke generally, and not in reference to In the Moment, “Real-time interaction management (RTIM) is a critical capability across vertical sectors, but especially in financial services, where it’s necessary to make brand-compliant and regulatory-compliant decisions about how to best serve customers across both digital and human-assisted channels. Though RTIM addresses marketing use cases, it also applies to sales, service, and other operational functions.”

On the difference between traditional martech and RTIM, Warner told Mi3,”Marketing-focused solutions are good at pre-approved content personalisation when requisite conditions are met, and that may meet the marketing needs of many organisations. For example, based on a predictive model and possibly a pre-approval process a customer may be a good candidate for a certain product, so the bank will send out a campaign or serve up content when the customer next logs into internet banking or opens the mobile banking app. Or possibly these customers will show up as leads for an outbound contact centre.

“This is often referred to as right customer, right message, right channel, right time, or something similar, but that’s just matching customers with canned offers versus decisioning based on real-time context.”

And he noted, “It’s a different use case from cross-functional “next best” decision-making that relies on real-time model execution aligned with business logic to consider not only the customer’s propensity for a certain marketing offer, but also factors in the real-time context merged with detailed historical data to understand the current interaction as part of the overall customer journey or holistic customer experience.”

“A more sophisticated RTIM solution will also consider the value to the brand beyond an immediate conversion, usually looking at customer lifetime value as a forward-looking profit contribution model, and it will also consider real-time business context,” he said.

That could include things like interest rates, market conditions, and real-world events that could inform and influence the appropriateness or priority of a communication.

Regulatory compliance in that context includes things like ASIC’s Design and Distribution Obligations, which came into force in October 2021. These place significant new constraints on financial institutions around using data for targeting, because it requires them to declare upfront their intended target market for any given product or service – with penalties for institutions that fall foul.

Warner also stresses that RMIT is not a single solution from a single vendor. “It relies on an ecosystem. For example, if Pega Customer Decision Hub makes the “next best” decision, it may still rely on Adobe to present the product/offer/action/experience via a website, or possibly personalise the content associated with it. Or perhaps the decision results in an outbound marketing campaign delivered via email by Salesforce, or it will be a conversation with a customer service representative using a contact centre solution or a financial advisor in a physical location using branch automation software.”

Every cloud…

EY, at least, came away with a win.

Part of the original deal was always that EY would own the IP and have the right to sell a solution. That’s what ultimately happened. Today the consulting firm sells what it calls its EY Cloud Data IQ Platform. It describes this as hosted in the cloud and supported by an EY managed service. According to EY, “It uses advanced visualisations and Artificial Intelligence (AI) to provide companies with a real-time, integrated view of customers’ interactions, intuitive client reporting, and detailed management information.”

Mi3 asked EY about its role in In the Moment but it declined to comment.

It’s possible the Law of Unintended Consequence might yet deliver an unexpected win out all of this for Westpac: The Attorney General is running the rule over automated decisioning as part of the Privacy Act overhaul. Having a relatively clean slate could at least save any re-compliance work.